As the Expert Network industry continues to impact how thousands of business decisions are made each day, our customers’ need for accurate, qualitative research continues to grow.

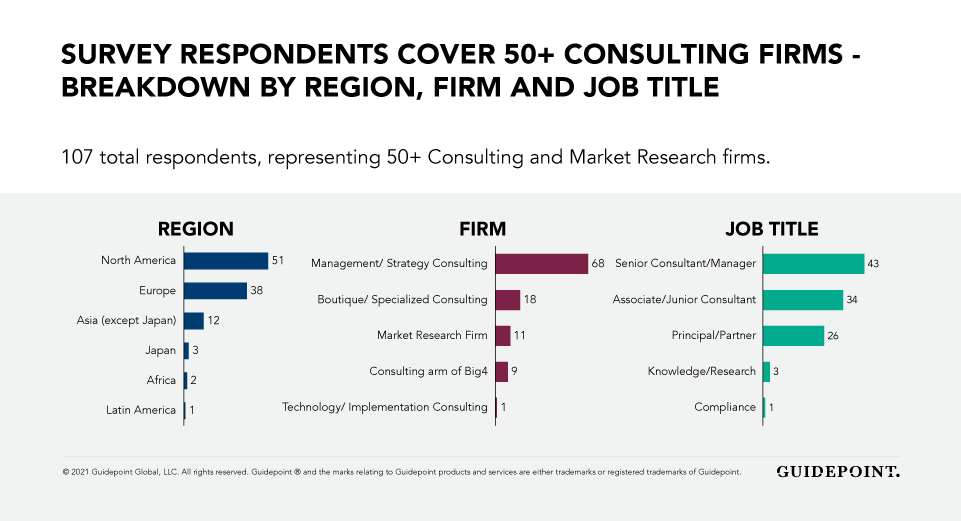

To understand how Expert Networks are being utilized in the current climate and gain the knowledge necessary to improve our services, Guidepoint has surveyed Expert Network users covering over 50 Consulting and Market Research firms across all geographic regions, with job functions ranging from Junior Consultants to Principals and Partners as well as Research / Knowledge Teams.

Guidepoint’s first Client Survey was completed by more than one hundred users, offering a window into how Expert Networks could better bridge the gap between customer expectations and customer experience.

THE RISING IMPORTANCE OF EXPERT NETWORKS IN CONSULTING

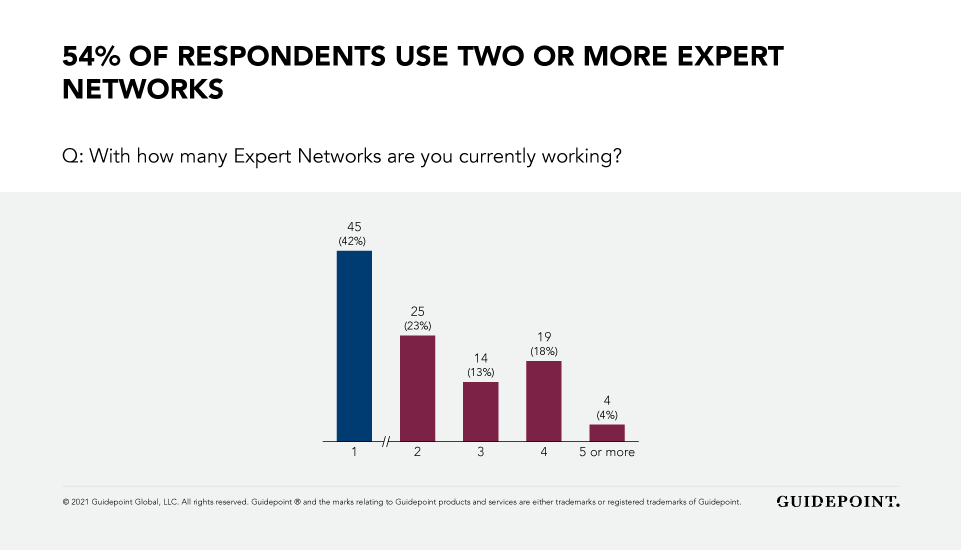

According to survey data, over half of respondents (54%) employ between 2-4 Expert Networks, followed by 42% of respondents who trust their research to one Expert Network, while the remaining 4% prefer to draw their conclusions from working with as many as five or more Expert Networks.

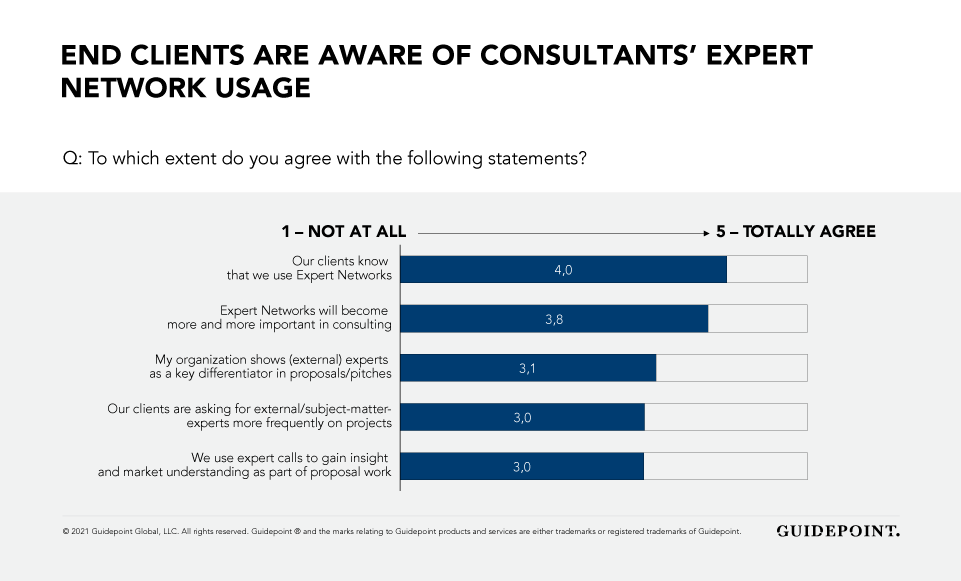

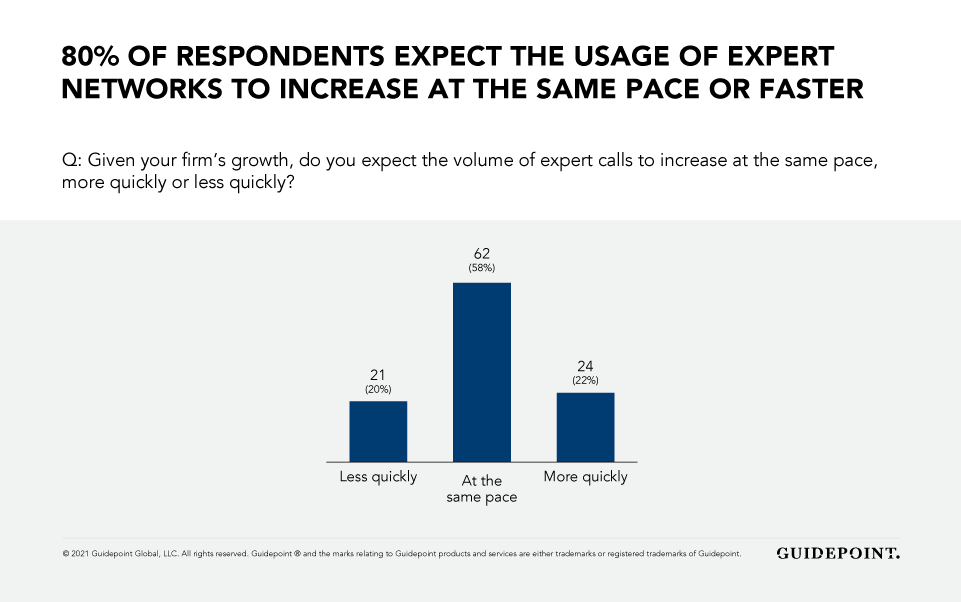

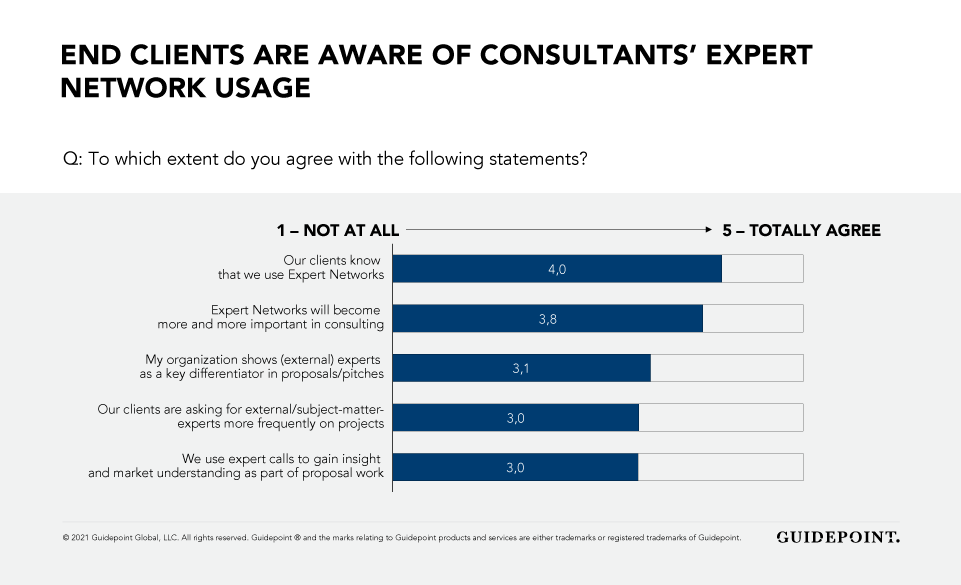

Of those surveyed, 3.8 out of 5 agree that Expert Networks will become increasingly important in Consulting, while 80% of respondents expect the volume of Expert Calls to increase at the same pace or faster as their firm’s business continues to grow.

Moreover, Guidepoint’s rapid growth with Consulting and Market Research firms reinforces how the rising importance of Expert Networks is not only an assumption derived from survey data, but a market shift we have experienced in real-time.

BEYOND DUE DILIGENCE

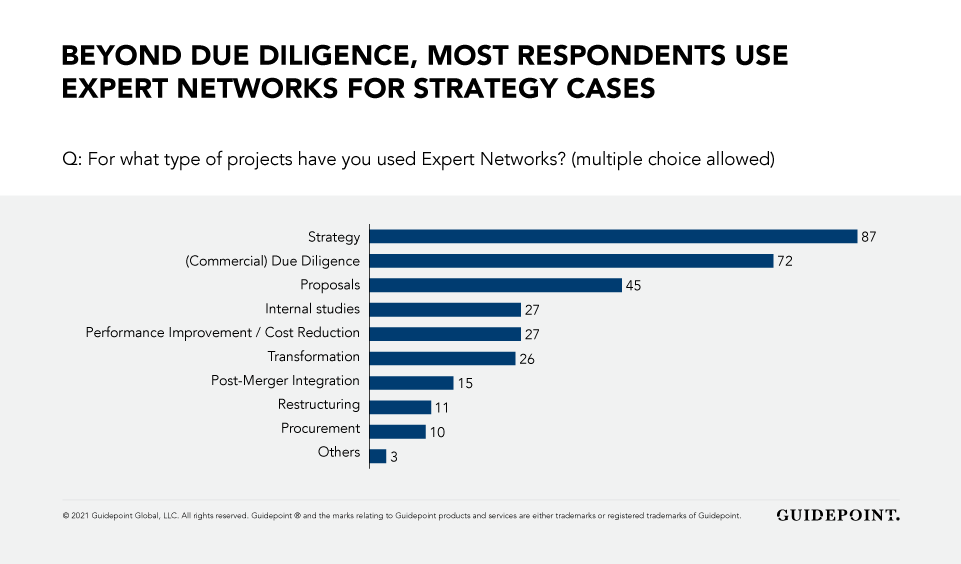

Perhaps one of the most unexpected findings is that conducting Due Diligence work on behalf of end-clients is no longer the main reason for Expert Calls. 87 respondents stated they use service providers such as Guidepoint on Strategy cases, making it the first use case ahead of Due Diligence cases (72).

Sure, one could argue that the use of Expert Calls will remain strongly driven by Merger & Acquisition-related projects, however, it seems that the majority of respondents recognize the need for Expert Network services in other cases.

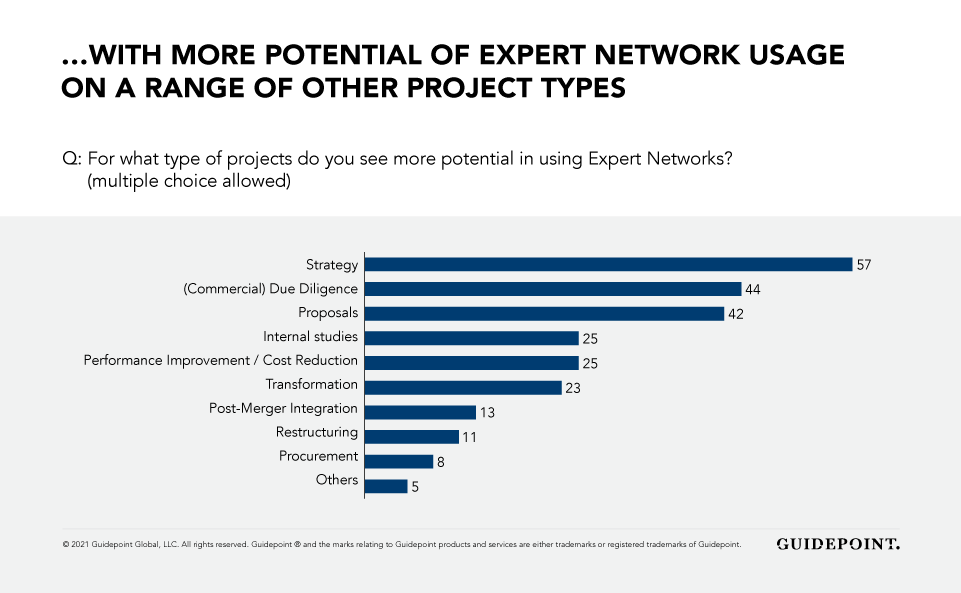

When asked in what type of Consulting projects they expect to increase their Expert Network usage, 57 respondents mentioned Strategy cases, 42 named Proposal work, followed by Internal Studies (25), Performance Improvement / Cost Reduction (25), and Transformation Projects (23).

BEYOND EXPERT CALLS

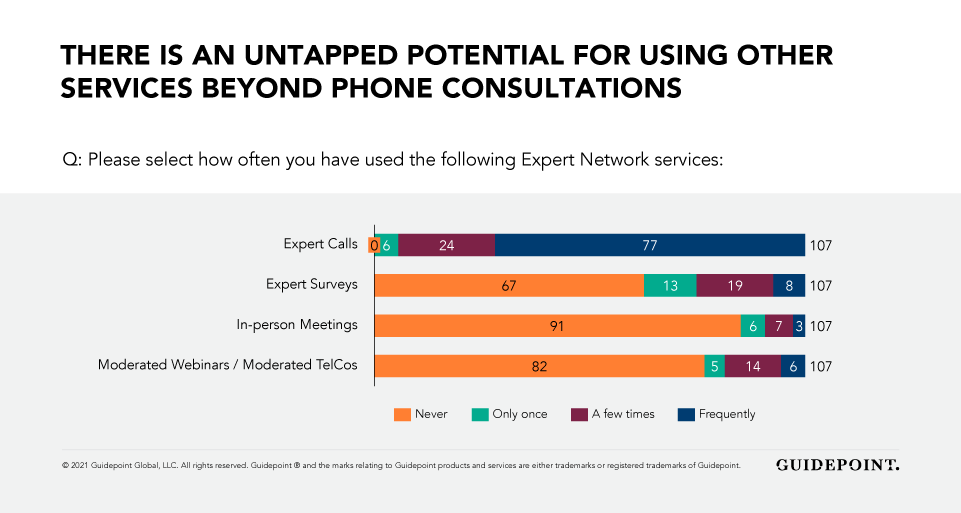

While most Consultants reaffirm the need for increased Expert Network usage on a variety of projects, the knowledge of using services beyond Expert Calls remains limited, with the majority of respondents stating to have never used services such as In-Person Meetings (85%), Moderated Webinars & Teleconferences (75%) or Expert Surveys (63%).

That said, it is apparent that many of the ways in which an Expert Network firm could add depth to findings beyond Due Diligence is still overlooked.

Indeed, as a primary service, it cannot be argued how or why Expert Calls benefit Consulting firms, especially when added features like Call Recordings and Transcriptions are made available to facilitate knowledge sharing and improve corporate oversight.

However, it is worth mentioning that Consultants should consider exploring other types of services, as this would enable them to reduce their research efforts on a wide range of projects.

For instance, most Strategy cases require testing complex hypotheses—relying on fast, accurate market insights. As it is crucial to gain a solid understanding of the market dynamics and the competitive landscape during the early stages, hiring seasoned subject market experts to be part of a team temporarily (for days, weeks, or in certain cases, months), would speed up project results and make them more actionable.

Similarly, Consultants could choose to elevate Proposal work by bringing in senior advisors to a pitch presentation and as a result, increase their firm’s chances of securing a new project.

Alternatively, if there are subject areas worth probing further, engaging Guidepoint’s Survey team could match qualitative insights with quantitative responses in as fast as 36 hours. Besides, Expert Surveys could help provide support in conducting Internal & External Studies as well as developing new frameworks, since this format was designed to deliver key insights from up to hundreds of qualified experts at once.

Furthermore, as more and more Consulting firms find themselves challenged by complex topics or rapidly changing market environments, taking advantage of a comprehensive service bundled under Guidepoint’s Insights offering could make all the difference in staying on top of recent developments and discovering future consulting opportunities. The Insights offering is comprised of high-quality, moderated live teleconferences, focus polls, roundtables, and group meetings.

With over 5,000 teleconference transcripts and audio transcripts available on request, plus 500 new uploads added to Guidepoint’s Insights Library monthly, Consultants can easily obtain foundational knowledge before an interview, provide additional context on market dynamics or trends, and most importantly, have the complete ability to realize their end client’s strategic vision at any time.

NO LONGER A “SECRET WEAPON IN THE BACKGROUND”

Having immediate access to a global network of leading subject matter experts makes it easy to meet challenging deadlines and obtain what would be otherwise categorized as ‘’hard-to-get’’ information, so it is clear to see why Consultants would perceive Expert Networks as their go-to option for primary research.

Nonetheless, how do end-clients feel about external research capabilities resourced through Expert Networks? According to Guidepoint’s Client Survey results, 4 out of 5 consent that end-clients are aware of their firm’s Expert Network usage, while 3 out of 5 have agreed that more clients are asking for Expert Networks to be frequently involved in Consulting projects.

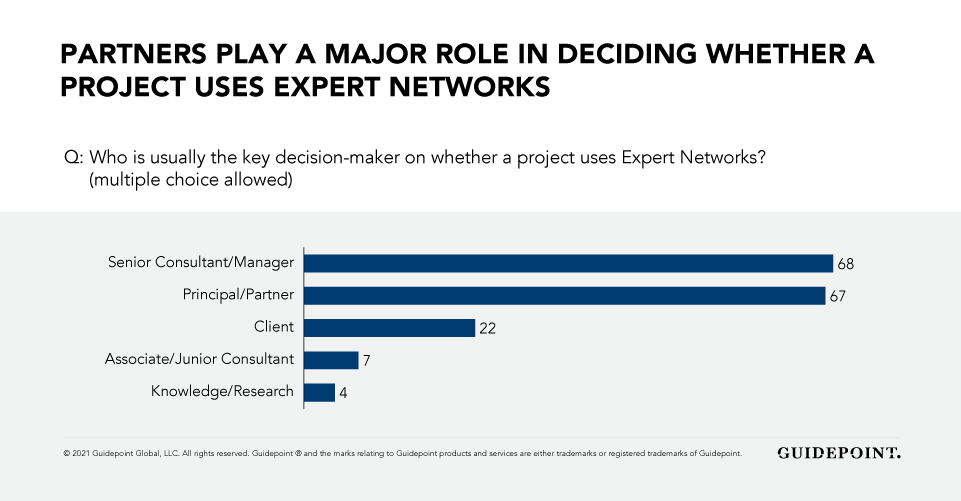

ENGAGING THE KEY DECISION MAKERS

When surveyed about who the key decision-makers are on whether a project uses Expert Network services, 67% of respondents stated that the decision primarily lies with Partners/Principals, and a similar number was attributed to Managers/Senior Consultants.

While end-clients might influence the decision of using external knowledge resources (22 respondents agree with this statement), the power of choice remains with the senior ranks in Consulting Firms.

It’s important to consider that in most firms only Partners/Principals would have the decision power over expenses for Expert Network usage, so it is up to them to include a budget for Expert Networks in their proposal – either agreeing on an exact amount of e.g., Expert Calls and directly passing through these costs to their clients or having it as part of the general project expenses.

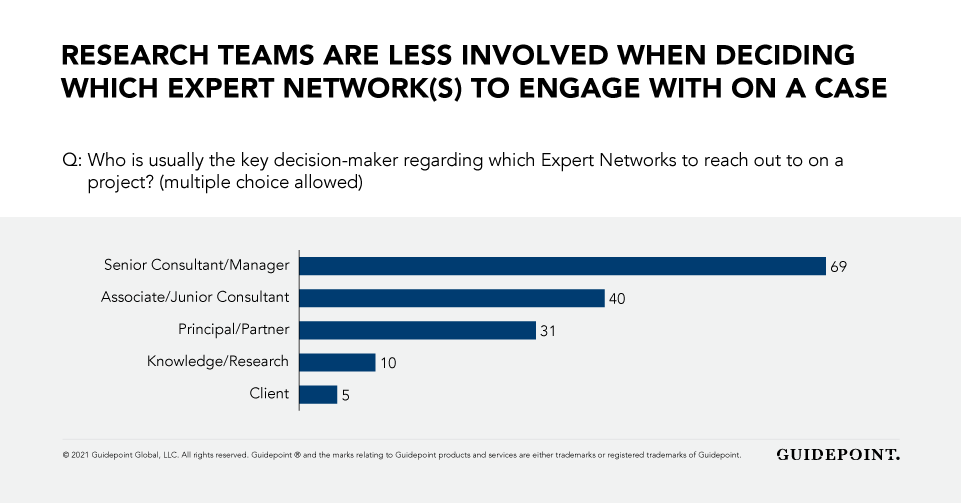

However, their responses differed when the same respondents were asked to indicate who chooses which Expert Networks get selected on a project, with a staggering 109 out of 155 respondents attributing this to either Associates/Junior Consultants or Senior Consultants/Managers. Surprisingly, neither Knowledge/Research teams (10) or more senior ranks (31) seem to be involved in the process of selecting an Expert Network.

With the more junior titles selecting the service providers, and given a rather high turnover rate among those ranks in Consulting, the importance of “word-of-mouth” becomes evident. This is particularly the case as Consultants might rely on certain networks based on the prior experience of their Project Managers, but it also means that their firms might risk using the same networks despite concerns about the level of service provided.

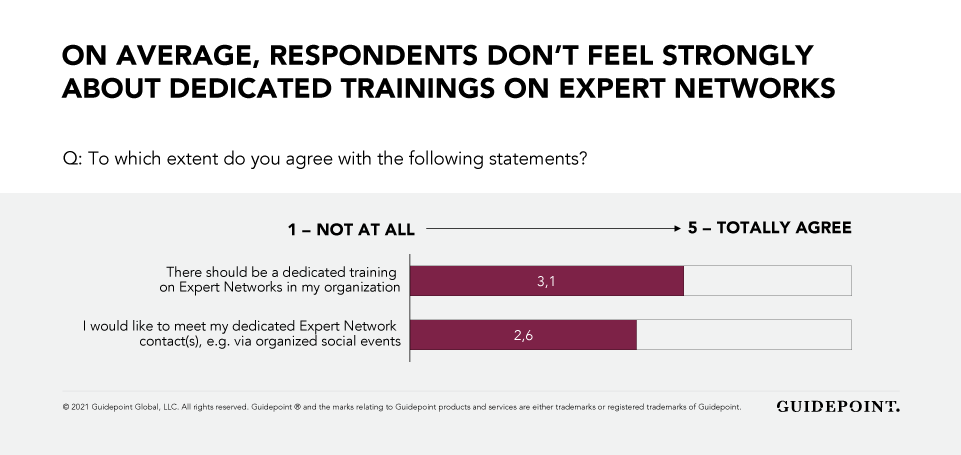

Simultaneously, it remains a challenge for most Expert Networks to build a consistent and trusted work relationship with Consulting Firms. While we have seen the value of formalized (or social) meetings between Guidepoint’s research teams and clients, the survey respondents are neutral about such meetings (2.6 out of 5 consent).

KEY FINDINGS

Most respondents agree that Expert Networks are becoming increasingly important in Consulting

- 80% of respondents expect the volume of expert calls to grow at the same pace or faster as their firm’s business continue to grow

Consultants have barely begun to scratch the surface when it comes to learning how to identify and leverage additional research services

- There is an untapped potential for using other services beyond phone consultations

While Expert Networks are recognized as a reliable source of primary research, there is still potential to develop true, custom service offerings

- End-clients are asking for external/subject-matter experts more frequently on projects

Consulting Firms should choose Expert Network firms carefully and place higher importance on their vendors’ performance on projects

- Partners decide if an expert network is used on a certain project – juniors define which and how many expert networks to involve